Frequently Asked Questions - All FAQs

Please select your question category

Search FAQs

| ||||||||||||||||||||||||||||||

|

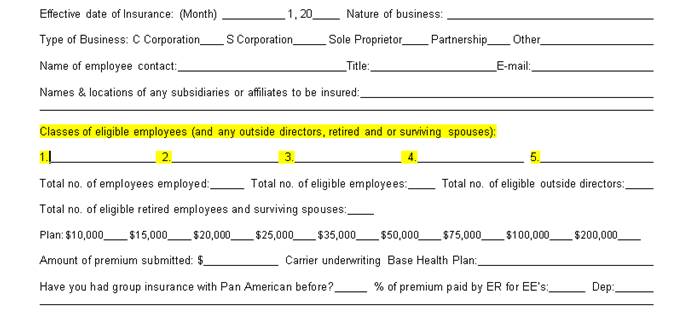

A Medical Reimbursement Plan is a fully insured reimbursement plan that allows an employer to reimburse key employees for most medical, vision, hearing and dental expenses not otherwise covered by their existing benefit plan. BeniComp Select allows employers to reimburse their key employees for most medical expenses not otherwise covered by their base health insurance plan. Rather than reward all employees at a company, the employer is able to reward individual employees or groups of employees by class. For example, an employer could create three classes:

These "classes" are created by the employer. An employer pays a $350 for each of the executive participants. This includes a $250 annual premium plus access to unlimited telemedicine. When a participant has eligible reimbursable expenses, they are submitted to BeniComp Select for reimbursement. The approved claim + 11% is paid by the employer, and BeniComp Select reimburses the key executive directly if they have signed up for direct deposit. No. The underlying plan can be an employer group plan, individual policy, spousal policy or Medicare. The employer selects the desired benefit level for each of the classes designated to the participating employees from the plan maximum schedule. Plan Maximums: $10,000, $15,000, $20,000, $25,000, $35,000, $50,000, $75,000, $100,000, $200,000 Accidental Death Benefit: Included with each BeniComp Select policy equal to the plan maximum up to $100,000 The policy covers the participant and any qualified dependents, and is based on specific state mandates. BeniComp Select follows the primary plan. If the primary plan allows for dependents up to the age of 26, then so does the BeniComp Select policy.

*The following individuals are ineligible to participate in a Cafeteria Plan, including a Premium Only Plan (POP) or any of its qualified benefits, which include FSAs and HRAs:

No, this policy can be placed on as few or as many employees, based on class, as the company chooses. Further, the company has the option of choosing different benefit levels on different classes of employees. Classes are determined by the company. If a policy is being offered to a class, everyone eligible for the designated class must be offered the plan. A BeniComp Select policy does not have an age limit or a waiting period. Concerning the use of a Health Savings Account (HSA) on a high deductible primary health plan (HDHP) that also has BeniComp Select supplementing the HDHP, it is our belief that you should seek the advice of your HSA advisor or tax adviser on the tax implications to also use an HSA when BeniComp Select supplements the primary plan. BeniComp’s underwriting only considers the primary plan to determine the eligibility for BeniComp Select to be an eligible supplement to the base medical plan. BeniComp makes no representations about other ancillary products or services not under our control. | ||||||||||||||||||||||||||||||

|

A BeniComp Select policy reimburses eligible medical expenses not otherwise covered by health insurance. Generally, if an expense is medically necessary and qualifies under Section 213(d) of the Internal Revenue Code, it would be eligible for reimbursement under this insurance plan. Some covered charges include, but are not limited to:

No benefits are payable unless the individual is under the direct care of a legally qualified physician for reasonable and necessary treatment. Any premiums including, but not limited to Base Plan (or Cobra Continuation of the Base Plan), Medicare Part B, Medicare Part D, Prescription Drug Plans Non-prescription drugs Losses due to war Expenses the individual is not legally obligated to pay in the absence of insurance Charges for appointments not kept Hospitalization, services, treatments or supplies furnished by the U.S. or foreign government agency, unless otherwise prohibited by law Service contracts or warranties relating to vision care Custodial care Accident or illness for which the individual is entitled to benefits under any worker’s compensation or occupational disease law Health club dues or exercise equipment Blood Storage Hospital charges for confinement in a long-term care unit or skilled nursing facility unless confinement commences within 14 days after discharge from a qualifying hospital confinement Baby sitting, childcare, and/or nursing services for a healthy child. You cannot include any amount paid for childcare even if this enables you, your spouse, and/or dependent(s) to receive medical treatment.

No. If vision, dental, and hearing are not covered by the underlying plan; BeniComp Select will reimburse the charges. Yes, master social services and psychologists are covered by BeniComp Select, even if the services are not covered by the underlying plan. Generally, if an expense is medically necessary and qualifies under Section 213 (d) of the Internal Revenue Code, it is eligible for reimbursement. Elective procedures that are not medically necessary are not covered by BeniComp Select.

You cannot include membership dues in a gym, health club, or spa as medical expenses, but you can include separate fees charged there for weight loss activities. You cannot include the cost of diet food or beverages in medical expenses because the diet food and beverages substitute for what is normally consumed to satisfy nutritional needs. You can include the cost of special food in medical expenses only if:

The amount eligible for reimbursement is limited to the amount by which the cost of the special food exceeds the cost of a normal diet. Due to recent IRS regulations, BeniComp Select will no longer reimburse any premiums effective January 1, 2016 including, but not limited to:

For more information and to view the revised policy form, please click here. | ||||||||||||||||||||||||||||||

| Interested in BeniComp Select Executive Medical Reimbursement but have questions about the application process? Classes of eligible employees are different "levels" you have designated for the company. For example, you might create levels for: Class 4: President Based on the levels you designate, you assign a certain number of employees to each class.

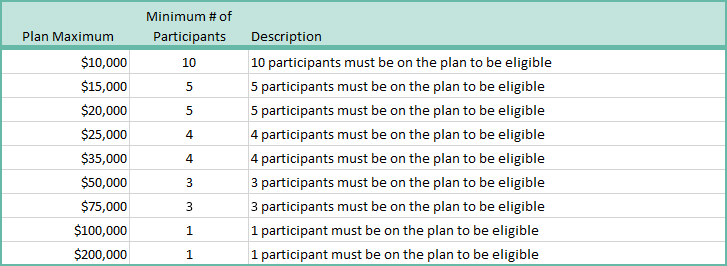

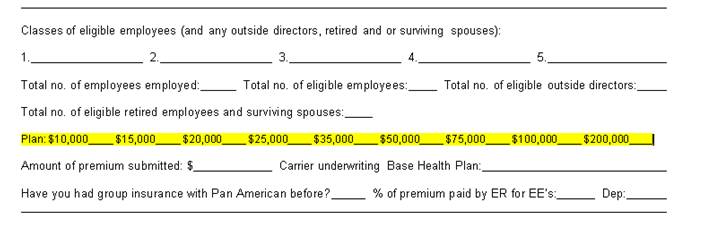

Please refer to the chart below. Based on the number of participants you have on the total plan, you can assign the number of participants to classes with corresponding plan maximums. For example, if you have 15 employees on BeniComp Select, you might have: Class 4: 1 President with a plan maximum of $25,000

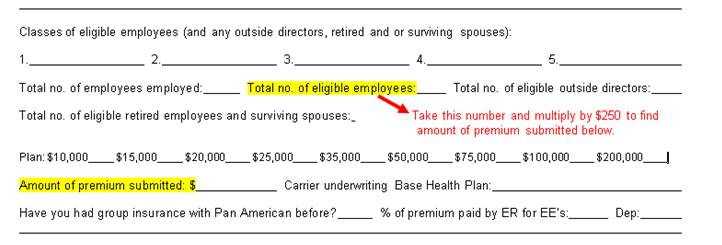

The application premium is the total number of participants multiplied by $250. For example, if you have 10 participants on BeniComp Select, then the premium check submitted with the application should be $2,500.

Yes, we support Apple products. By default, the Safari browser blocks pop-up windows. See below: When you are on your iPhone, the safari browser defaults to no pop-ups.

| ||||||||||||||||||||||||||||||

|

Supporting documentation must be included with any expense submitted for reimbursement. The Explanation of Benefits (EOB) supplied by the primary plan needs to be included with every medical claim to show the services provided went through the primary plan first. If the service provided is explicitly not covered by the primary plan, please submit the Summary Plan Description explaining the service is not covered. Further examples of supporting documentation include, but are not limited to:

All supporting documentation, including photocopies, must be legible and include the patient's name, date and type of service, and the dollar amount. Claims cannot be processed from:

No, you do not need to upload each claim item's supporting documentation separately. You can upload all of the supporting documentation one time under Supporting Documentation Upload. Accepted file types include pdf, png, jpg, gif. bmp, and tiff. We do not accept xls, xlsx, csv, txt, zip, or doc. Please simplify the file name of your supporting documentation and exclude special characters. Submitting claims is based off your policy year. You have 90 days past your renewal to submit claims for the previous policy year. See below for how this affects your group:

BeniComp Select can send your reimbursement by direct deposit if you have submitted an EFT form. EFT forms can be filled out by clicking here. Yes, when you submit your claims online they go directly into BeniComp's system for processing. This results in fewer handwritten processing errors and much faster reimbursement.

I received an email saying my Explanation of Benefits can now be viewed online; what does this mean?

When you sign up for Direct Deposit you are also enrolled in eBeniComp, which you can access by going to www.eBeniComp.com to view your Explanation of Benefits (EOBs) online. The Explanation of Benefits provides details for what claims have been processed; including both approved and denied claims. Your entire claims history is stored in eBeniComp in the form of EOBs and can be accessed at any time. For log in information, please refer to the confirmation email you received when your Direct Deposit was initially set up. If you do not have Direct Deposit and would like to enroll, please go to www.benicompselect.com/eft to sign up. If you cannot find your confirmation email, please call our customer service line at 866-797-3343 for assistance. Yes, as long as your group is domiciled in the United States and offers a group health plan, a participant can incur a claim outside of the United States' borders. In order to process these claims, the participant is responsible for translating the supporting documentation to English and converting the funds to American Dollars. | ||||||||||||||||||||||||||||||

|

Pulse was built to be compatible with Google Chrome, Microsoft Edge, Mozilla, Safari. If you are the group administrator, your username will be sent to you from a Pulse email, pulse@benicomp.com, and will be your company name with no spaces. For example, Wayne Enterprises' username would be "wayneenterprises". If you are a participant you will create your own username upon your first login. If you have forgotten your username you can contact us at 866-797-3343 or solutions@benicomp.com. When logging in for the first time, you will receive an email from pulse@benicomp.com that provides you with your username and temporary password. Navigate to portal.benicomp.com and enter this username and temporary password. Once logged in, Pulse prompt you to create a new password along with setting your security questions. If you ever want to change your password or security questions, you can do so under "My Settings" by hovering over your avatar at the top right corner of your Portal. Once on the "My Settings" screen, you will need to enter your current password before you can make any changes to your password or security questions. You can change your password and security questions under "My Settings" in your portal. Simply hover over the avatar at the top right corner. Once on the "My Settings" screen, you will need to enter your current password before you can make any changes to your password or security questions. There is only one set of credentials assigned to each account right now. We will be rolling out new features in the coming weeks that will include multiple users for each account, along with other exciting news. Stay tuned! There is only one set of credentials assigned to each account right now. We will be rolling out new features in the coming weeks that will include multiple users for each account, along with other exciting news. Stay tuned! An invoice notification will be sent to all accounting contacts whenever an invoice is issued. The email will be coming from pulse@benicomp.com and will include a summary of the invoice. You can view the full details of the invoice by logging in to your portal. If you do not receive this email, check your spam and/or get with your security administrator to check to see if the email was caught in your firewall. You can pay for one or multiple invoices using the "Pay Now" button in you Billing section. You can also sign up for EasyPay, our automatic payment system. By doing so, you don't have to login and click Pay Now, the invoices will be paid with the default bank information you set whenever an invoice is issued. Yes, simply select the invoices you wish to pay and click the "Pay Now" button at the top right corner. Yes, you can add any checking or savings account. You can do so on the payment screen or by navigating to the "My Banking" section under your profile by hovering over your avatar at the top right corner. Here you can add, edit, and delete bank accounts as well as set your default payment method and sign up for EasyPay, our automatic payment system. Yes! You can save as many accounts as you need. Navigate to the "My Banking" section under your profile by hovering over your avatar at the top right corner. Here you can add, edit, and delete bank accounts as well as set your default payment method. You can also sign up for our automatic payment system, EasyPay. EasyPay is our automatic payment system. By opting in to EasyPay under your "My Banking" section, you authorize all issued invoices to be automatically paid using the default banking information. You will still receive email notification for every invoice issued, but there is no need to login and pay each and every invoice. EasyPay is only applied to future invoices, so if you have open invoices prior to signing up for EasyPay, then you will need to pay the open invoices under "Billing". All future invoices will be automatically paid with no manual intervention from you. No we do not accept credit card payments. We accept payments from any Checking or Savings account. Yes! You can download one or multiple invoices and the supporting Request For Funding that details what is included in the invoice. You can one invoice by clicking on the down arrow of that invoice under the "actions" column. To download multiple, you can select the invoices you want and click "download" at the top right corner of your screen. We highly encourage Clients to pay using Pulse Pay. We made submitting electronic payments easy and painless to expedite the turnaround time for participant reimbursement. No more waiting for the US Postal Service and wondering if your check was lost in the mail. We currently still accept check payment, but may not in the future. | ||||||||||||||||||||||||||||||